After reviewing the appraisal i did comment that the solar panels had been mentioned but as the ho stated no adjustment was applied.

No credit for solar panels on appraisals.

And many states have great incentives for renewable energies.

The ho seemed dismayed as there was no adjustment credit for the solar panels they had put on their house.

The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing an average sized residential solar.

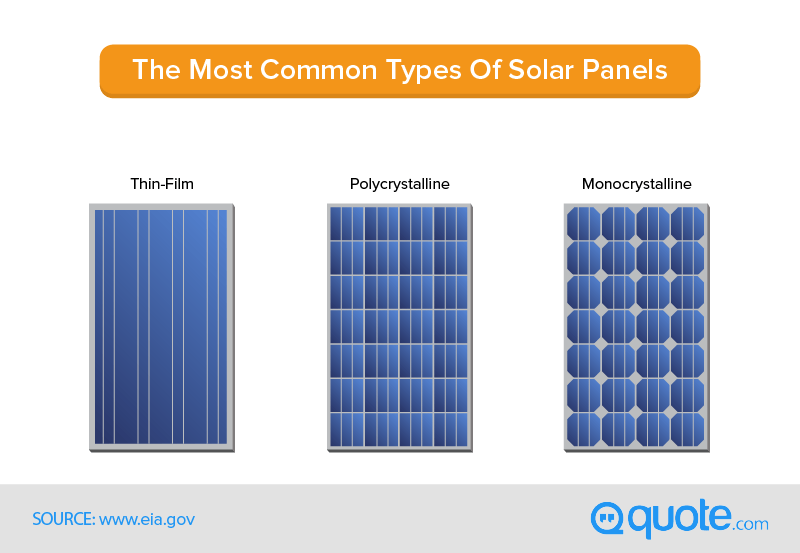

Solar panels and green homes are becoming increasingly more common in the marketplace.

Determining the value of solar panels is an issue that has many appraisers asking questions.

If the seller wants to be reimbursed for some of the cost of the panels in the value of the property some appraisers have opined that they would likely consider the following factors.

The federal tax credit allows you to deduct 30 off the cost of installing a solar energy system.

Expect to pay a lot less for your solar energy system after you factor in these advantages.

If you ve seen a rise in solar panels in your area consider taking the first step toward competency in the valuation of this energy efficient feature of real estate.

Lower your electric bill.

By the way solar pv means solar photo voltaic.

I asked the ho if they contacted the appraiser and asked them about the adjustment and the ho reported that the appraiser stated there are no comparables with solar panels.

The basis of the report is how to value the appraised property with solar panels when no comps have them using paired sale analysis.

This panels are designed to convert sunshine or even cloudy daylight into usable electrical energy.