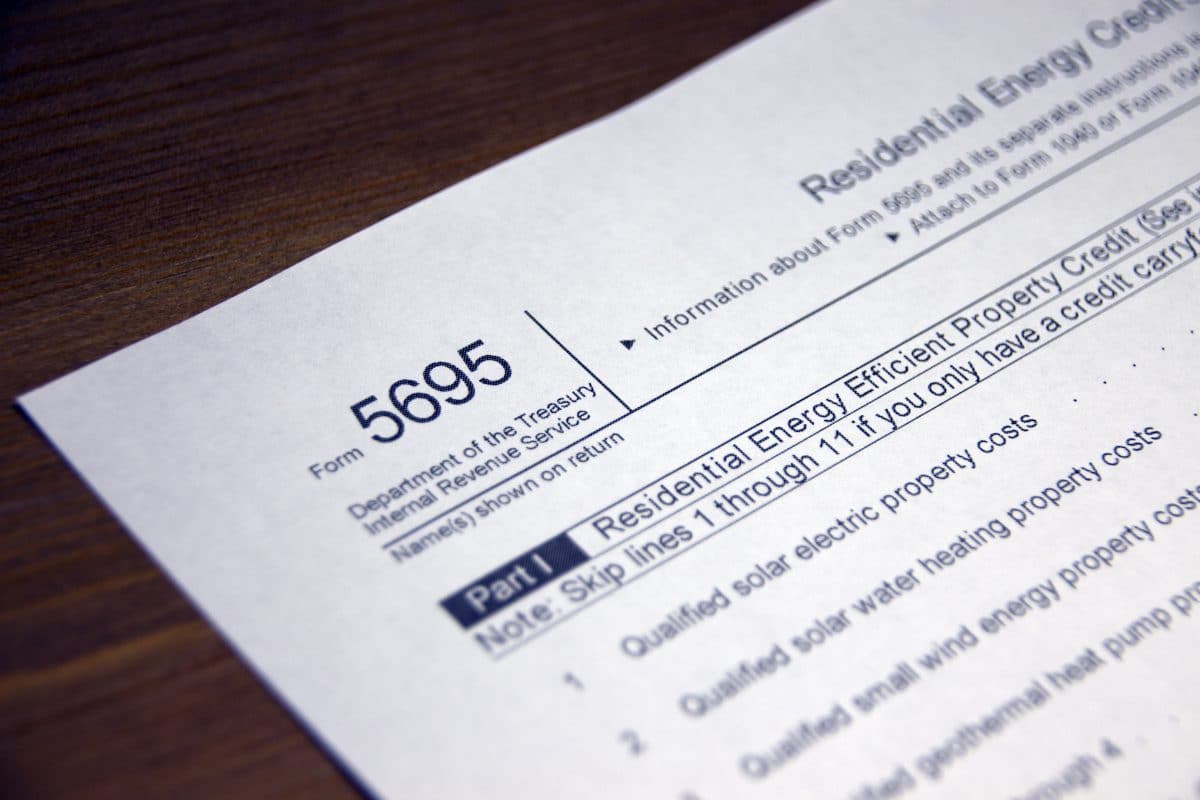

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

Nonbusiness energy property credit solar panels.

10 of cost up to 500 or a specific amount from 50 300.

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property and fuel cell property.

The itc applies to both residential and commercial systems and there is no cap on its value.

Tax credit for solar panels installed in residential property a valuable 30 credit for the cost of solar panels and related property is available for qualifying property installed in residential property used as a personal residence as well as for residential property held for rent.

Labor costs for onsite preparation assembly or original installation were included as eligible expenses for certain items.

Nonbusiness energy property provided a credit for buying qualified energy efficiency improvements and provided credits in various amounts for costs relating to residential energy property expenses 26 u s c.

The non business energy property tax credits have been retroactively extended from 12 31 2017 through 12 31 2020.

25c a 2.

48 provides for a solar energy tax credit for the installation of solar panels as part of the general business credit under sec.

25d does not allow a solar tax credit for the cost of installing solar panels for use in residential rental property sec.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

For example a fuel cell with a 5 kw capacity would qualify for 5 x 1 000 5 000 tax credit.

The federal solar tax credit also known as the investment tax credit itc allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes.

48 is more favorable.